Just a sec...

Just a sec...

We make the gold standard for SME evaluation available to everyone in the market. Banks, Industry and SMEs themselves can now benefit from a transparent, fair and easily accessible standard.

Reduced uncertainty. Increased efficiency. Better decisions.

Our risk assessments are ready for use in any context, from banking to trade credit to your everyday business partner evaluation.

Our evaluations are taking the specific details of SMEs into account by combining multiple assessment approaches.

Our evaluations are easy to understand and use, they are available for all SMEs and it only takes minutes to get a full report.

Our solution is built with a clear focus on the digital world. Ready to simplify processes and help you be more efficient.

All our solutions are enabled by our revolutionary SME risk evaluation approach.

The new Swiss Standard for Digital Trust

Our software suite tailored specifically for use in banking

Loan eligibility information for SMEs - fast, anonymous & free

Our digital tool supporting conversations with business customers

We are constantly working on new ways to improve SME risk assessment. Our goal is to always provide the most truthful representation of reality for any SME.

Founder

Product & Tech

matthias [at] ratyng.com

Founder

Commercial & Operations

volker [at] ratyng.com

Questions? Intersted in our products and solutions? Just leave your contact information and we will get in touch with you.

Created in collaboration with our partner Intrum, CoRa revolutionizes SME credit rating, creates transparency and offers benefits for SMEs as well as their business partners.

Our digital certificate, evaluates SMEs and allows them to communicate their reliability without disclosing sensitive financial data. At the same time, the CoRa certificate allows SME business partners to rate the SME much more easily and reliably than any other option currently available. The CoRa Certificate: the new Swiss standard for digital trust.

Our software suite tailored specifically for use in banking

IntegrationOne line of Code.

DesignJust as your website.

PrivacyHosted exclusively in Switzerland.

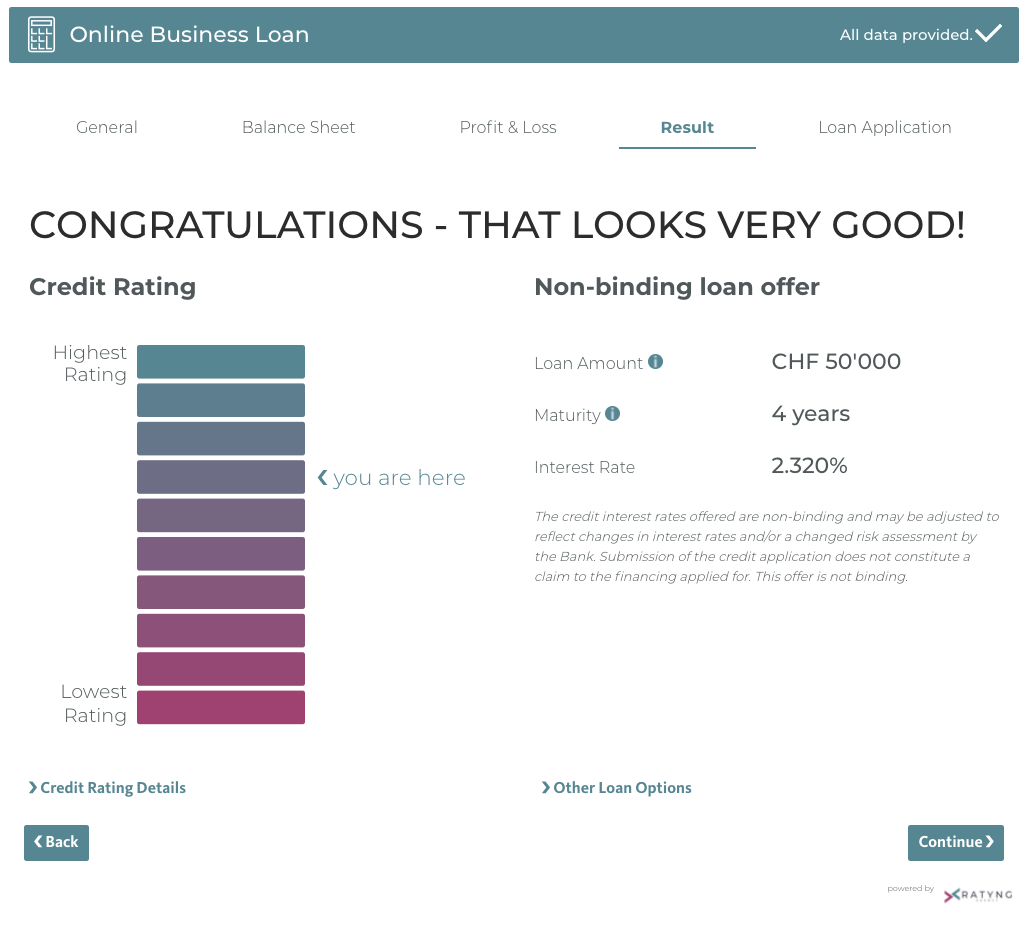

OnLoan provides banks and other lenders the ability to offer true online business loans. With a few clicks and a handful of inputs, businesses can anonymously check not only if getting a loan is an option, but also what interest rate applies. The full loan application (including risk assessment) can be completed in a couple of minutes.

go to onloan.ch for more details.

SMEs often find getting a loan cumbersome. 8% of Swiss SMEs could use a loan, but never even apply for one. Our SME Loan Calculator helps SMEs answer the question if they are eligible for a loan. It is 100% anonymous, provides immediate feedback and best of all: it is completely free of charge.

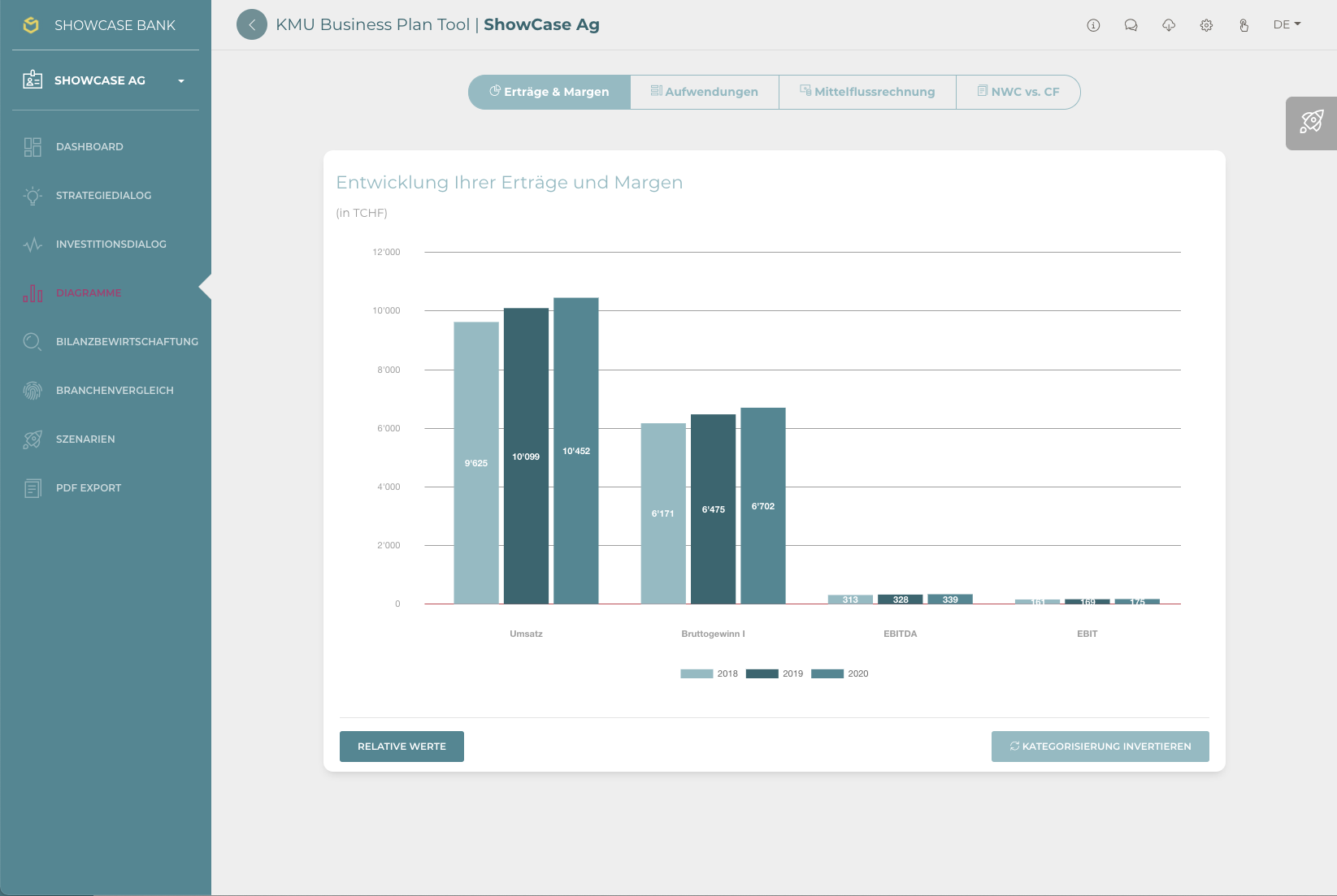

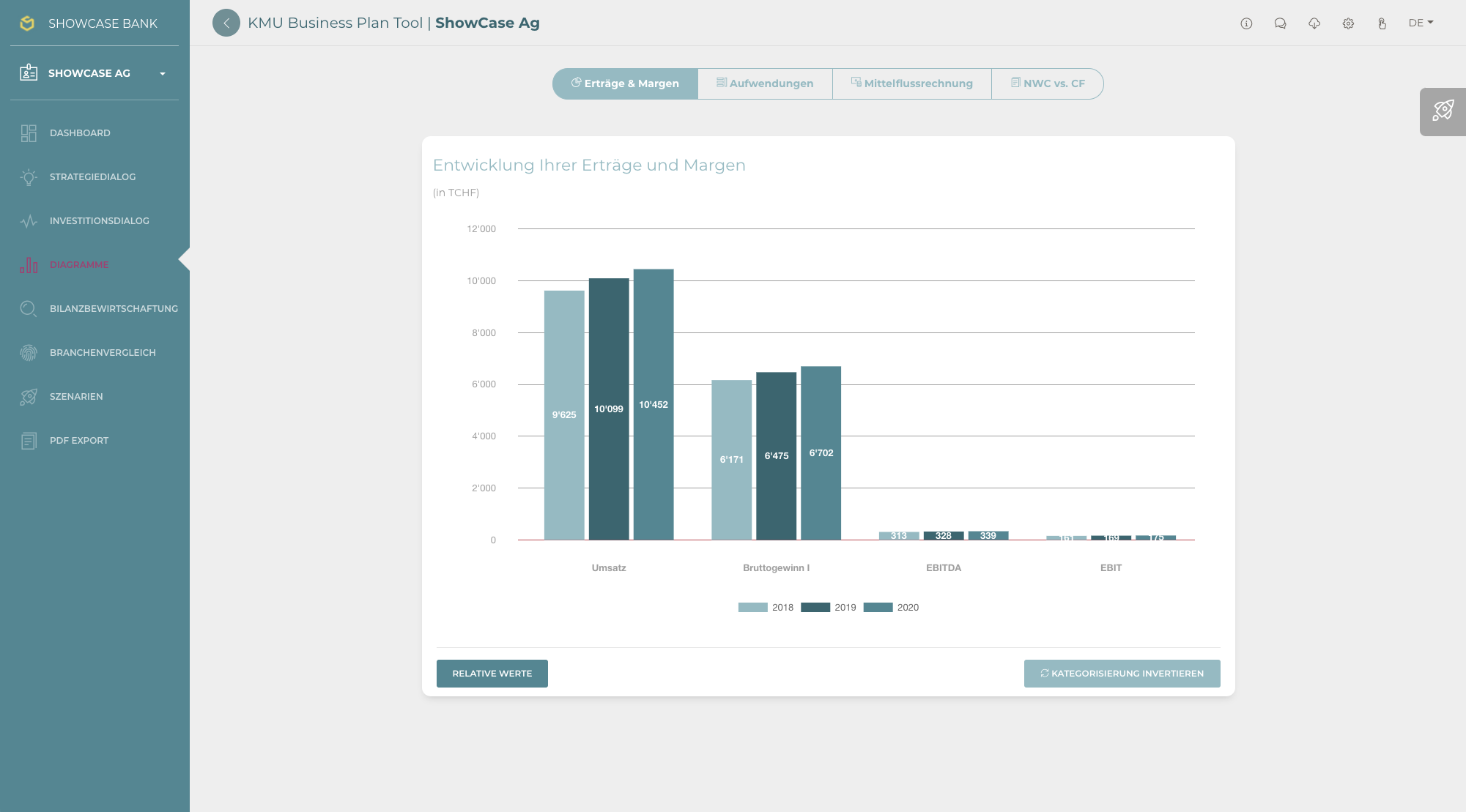

The annual discussion with your business customers is a great opportunity to recap the last year and make plans for the next. Our Business Plan Tool (BTP) supports your conversation by guiding it along relevant topics, visualizing past financials, offering easy options for modelling future scenarios and much more.

The BPT combines 7 modules to support the conversation:

Dashboard provide a short overview of the customer and start into your conversation

Dialogues highlight relevant topics for the conversation

Diagrams visualize key figures and link them to dialogue topics

Working Capital Simulation show the impact of working capital on cash flow

Industry Benchmarks compare key figures with other companies from the industry

Debt Capacity determine the potential for additional financing

Scenarios develop a sustainable scenario and discuss investments opportunities to increase growth or reduce costs

Seamlessly integrated into your system, design and relying on existing data, the Business Plan Tool brings the conversations with your customers to the next level.

OnLoan GmbH

Zürichbergstrasse 38

8044 Zürich

Represented by the managing directors: Volker Haushalter & Matthias Schaller

E-mail: hi@onloan.ch

Einleitung

Gestützt auf Artikel 13 der schweizerischen Bundesverfassung und die datenschutzrechtlichen Bestimmungen des Bundes (Datenschutzgesetz, DSG) hat jede Person Anspruch auf Schutz ihrer Privatsphäre sowie auf Schutz vor Missbrauch ihrer Personendaten. Wir halten diese Bestimmungen ein. Ihre Personendaten werden streng vertraulich behandelt und nicht an Dritte verkauft, können aber gemäss dieser Datenschutzerklärung teilweise an Dritte zur Bearbeitung weitergegeben werden.

Bitte lesen Sie diese Datenschutzerklärung sorgfältig durch, denn sie beschreibt, wie und zu welchem Zweck Ihre Personendaten bearbeitet werden, wenn Sie diese Website besuchen.

Ratyng (Onloan GmbH) ist als Datenverantwortlicher für die Bearbeitung Ihrer Personendaten auf dieser Website verantwortlich. Bei weiteren Fragen zur Bearbeitung von Personendaten oder für die Ausübung von Auskunftsrechten kontaktieren Sie uns bitte auf die folgende Adresse:

Onloan GmbH, Zürichbergstrasse 38, 8044 Zürich, Schweiz

Beim Zugriff auf unsere Webseiten werden folgende Daten gespeichert: IP-Adresse, Datum, Uhrzeit, sowie sämtliche von Ihnen eingegebenen Daten sowie hochgeladene Dokumente.

Vollständige Informationen zu jeder Art von bearbeiteten Personendaten werden in den dafür vorgesehenen Abschnitten dieser Datenschutzerklärung erläutert.

Personendaten können vom Nutzer freiwillig angegeben oder, im Falle von Nutzungsdaten, automatisch erhoben werden, wenn diese Webseite genutzt wird.

Sofern nicht anders angegeben, ist die Angabe aller durch diese Website angeforderten Daten obligatorisch. Weigert sich der Nutzer, die Daten anzugeben, kann dies dazu führen, dass diese Website dem Nutzer ihre Dienste nicht zur Verfügung stellen kann. In Fällen, in denen diese Website die Angabe von Personendaten ausdrücklich als freiwillig bezeichnet, dürfen sich die Nutzer dafür entscheiden, diese Daten ohne jegliche Folgen für die Verfügbarkeit oder die Funktionsfähigkeit des Dienstes nicht anzugeben.

Nutzer, die sich darüber im Unklaren sind, welche Personendaten obligatorisch sind, können sich an den Verantwortlichen wenden.

Die Nutzer sind für alle Personendaten Dritter verantwortlich, die durch diese Website beschafft, veröffentlicht oder weitergegeben werden, und bestätigen, dass sie die Zustimmung zur Übermittlung von Personendaten etwaiger Dritter an diese Website eingeholt haben.

Wir weisen darauf hin, dass die Datenübertragung im Internet (z.B. bei der Kommunikation per E-Mail) Sicherheitslücken aufweisen kann. Ein lückenloser Schutz der Daten vor dem Zugriff durch Dritte ist nicht möglich.

Wir bearbeiten die Nutzerdaten auf ordnungsgemäße Weise und ergreifen angemessene Sicherheitsmaßnahmen, um den unbefugten Zugriff und die unbefugte Weiterleitung, Veränderung oder Vernichtung von Daten zu vermeiden.

Die Datenverarbeitung wird mittels Computern oder IT-basierten Systemen nach organisatorischen Verfahren und Verfahrensweisen durchgeführt, die gezielt auf die angegebenen Zwecke abstellen. Zusätzlich zum Verantwortlichen könnten auch andere Personen intern (Personalverwaltung, Vertrieb, Marketing, Rechtsabteilung, Systemadministratoren) oder extern – und in dem Fall soweit erforderlich, vom Verantwortlichen als Auftragsbearbeiter benannt (wie Anbieter technischer Dienstleistungen, Zustellunternehmen, Hosting-Anbieter, IT-Unternehmen oder Kommunikationsagenturen) – diese Website betreiben und damit Zugriff auf die Daten haben. Eine aktuelle Liste dieser Beteiligten kann jederzeit vom Verantwortlichen verlangt werden.

Die Internetseiten verwenden teilweise so genannte Cookies. Cookies richten auf Ihrem Rechner keinen Schaden an und enthalten keine Viren. Cookies dienen dazu, unser Angebot nutzerfreundlicher, effektiver und sicherer zu machen. Cookies sind kleine Textdateien, die auf Ihrem Rechner abgelegt werden und die Ihr Browser speichert.

Die meisten der von uns verwendeten Cookies sind so genannte «Session-Cookies». Sie werden nach Ende Ihres Besuchs automatisch gelöscht. Andere Cookies bleiben auf Ihrem Endgerät gespeichert, bis Sie diese löschen. Diese Cookies ermöglichen es uns, Ihren Browser beim nächsten Besuch wiederzuerkennen.

Sie können Ihren Browser so einstellen, dass Sie über das Setzen von Cookies informiert werden und Cookies nur im Einzelfall erlauben, die Annahme von Cookies für bestimmte Fälle oder generell ausschließen sowie das automatische Löschen der Cookies beim Schließen des Browsers aktivieren. Bei der Deaktivierung von Cookies kann die Funktionalität dieser Website eingeschränkt sein.

Bei den Cookies kann es sich auch um solche von Drittanbietern handeln.

Wir verwenden den «HTML5 Local Storage» zum wiedererkennen mehrfacher Nutzung durch denselben Nutzer und zur Speicherung temporärer Anwendungsdaten auf Ihrem Rechner. Local Storage ist eine Technologie, mit welcher ihr Browser Daten auf Ihrem Rechner oder Mobilen Gerät abspeichert. Wir verwenden diese Technologie, um die Navigation und Nutzung unserer Website möglichst benutzerfreundlich zu gestalten. Wir benötigen diese Technologie weiterhin, um Sie zu identifizieren.

Im Local Storage werden Ihr Vorname, Nachname, und Ihre Adresse gespeichert. Der Local Storage wird nach 72 Stunden (beim nächsten Besuch der Webseite) oder bei Abschluss des Prozesses gelöscht.

Sie können die Verwendung des «HTML5 Local Storage» durch entsprechende Einstellung in Ihrem Browser verhindern. Jedoch weisen wir Sie darauf hin, dass bei der Deaktivierung des Local Storage die Funktionalität dieser Website eingeschränkt sein kann.

Auf die im Local Storage gespeicherten Daten können Dritte nicht zugreifen. Sie werden an Dritte nicht weitergegeben und auch nicht zu Werbezwecken verwendet.

Der Provider der Seiten erhebt und speichert automatisch Informationen in sogenannten Server-Log Files, die Ihr Browser automatisch an uns übermittelt. Dies sind:

Diese Daten sind nicht direkt bestimmten Personen zuordenbar. Eine Zusammenführung dieser Daten mit anderen Datenquellen wird nicht vorgenommen. Wir behalten uns vor diese Daten nachträglich zu prüfen, wenn uns konkrete Anhaltspunkte für eine rechtswidrige Nutzung bekannt werden.

Diese Daten sowie alle Daten dieser Website werden bei Microsoft Azure ausschliesslich in der Schweiz gespeichert.

Diese Seite nutzt aus Gründen der Sicherheit und zum Schutz der Übertragung vertraulicher Inhalte, wie zum Beispiel der Anfragen, die Sie an uns als Seitenbetreiber senden, eine SSL-Verschlüsselung. Eine verschlüsselte Verbindung erkennen Sie daran, dass die Adresszeile des Browsers von «http://» auf «https://» wechselt und an dem Schloss-Symbol in Ihrer Browserzeile.

Wenn die SSL Verschlüsselung aktiviert ist, können die Daten, die Sie an uns übermitteln, nicht von Dritten mitgelesen werden.

Wenn Sie uns per Kontaktformulare Anfragen zukommen lassen, werden wir Ihre Angaben aus dem Anfrageformular inklusive der von Ihnen dort angegebenen Kontaktdaten ausschließlich für die Bearbeitung der Anfrage nutzen. Hierfür teilen wir auch Daten mit Drittanbietern.

Sie haben jederzeit das Recht auf unentgeltliche Auskunft über Ihre gespeicherten Personendaten, deren Herkunft, Empfänger und den Zweck der Datenbearbeitung sowie ein Recht die Berichtigung, Sperrung oder Löschung dieser Daten zu verlangen.

Wir behalten uns vor, jederzeit Änderungen an dieser Datenschutzerklärung vorzunehmen. Nutzern wird daher nahegelegt, diese Seite regelmäßig aufzurufen und dabei das am Seitenende angegebene Datum der letzten Änderung zu prüfen.

Letzte Aktualisierung: 22. Januar 2024